Podcast: Play in new window | Download

Subscribe: RSS

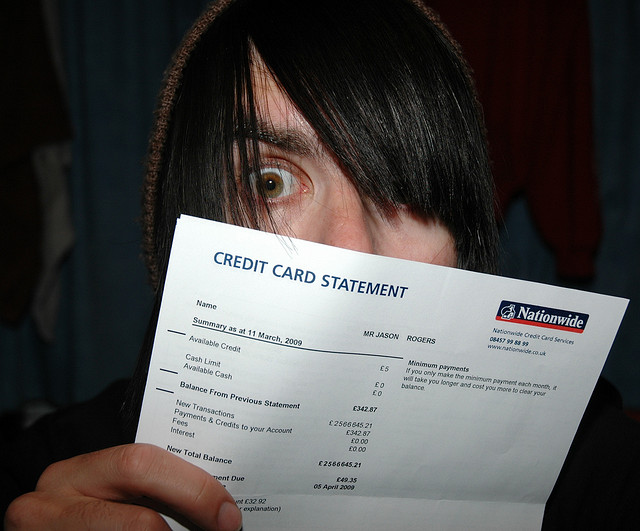

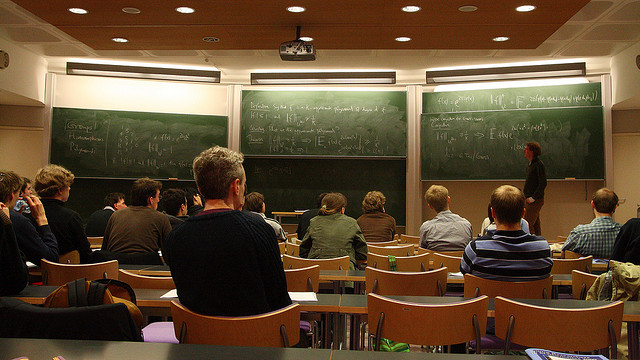

A CNBC anchor after trying to explain hedging against the volatility of stocks indexed to the Volatility Index. The end is near now.

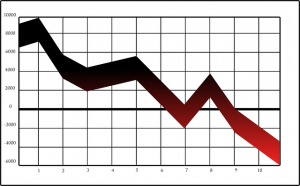

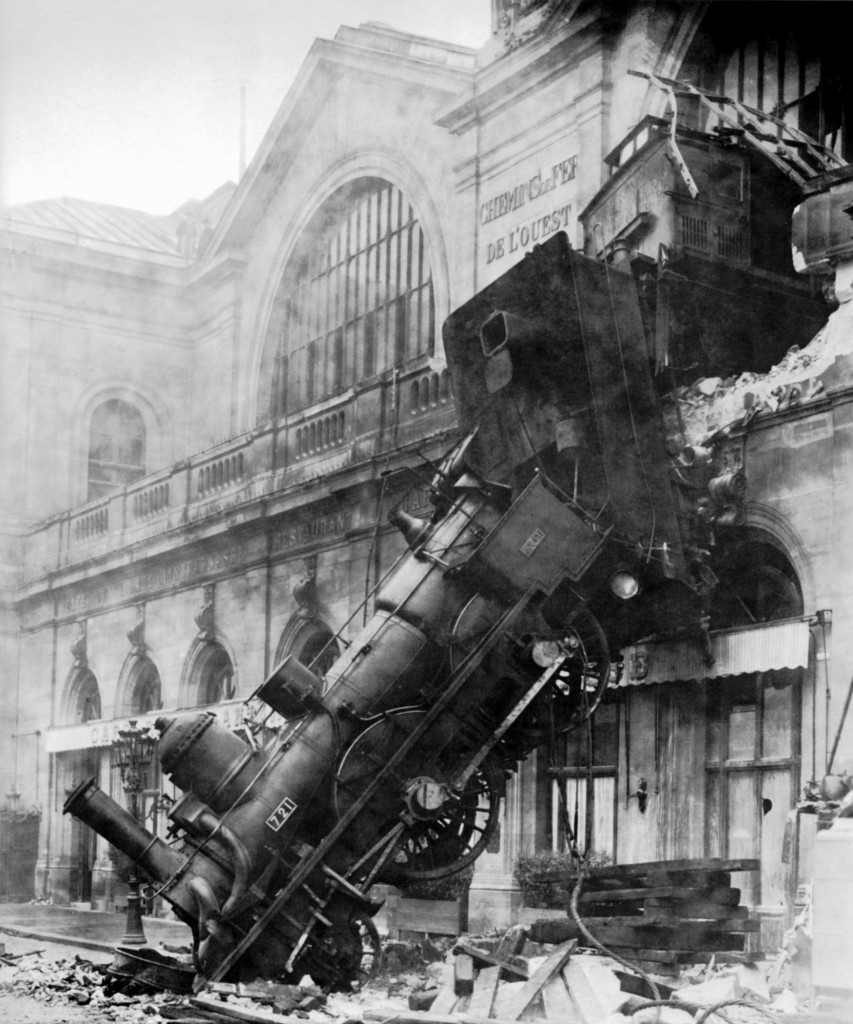

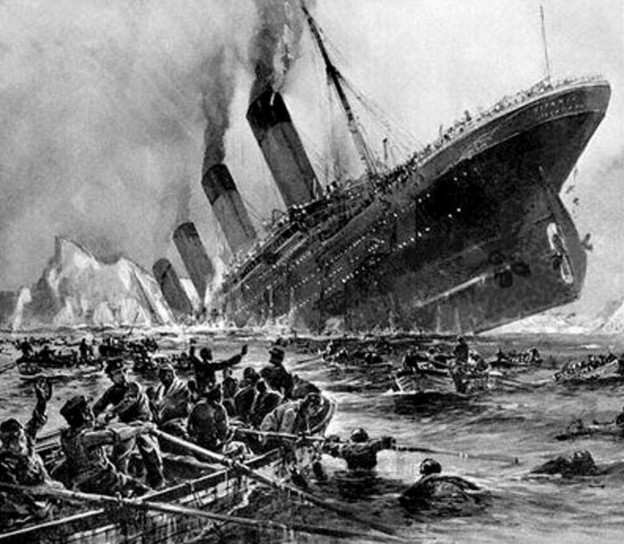

Screw it, I’m calling it. I’ve been watching the so-called “markets” of China, the United States and a couple dozen other countries fall off a cliff, get up, stagger upward, fall off another cliff, and repeat. I’ve been listening to the chattering class say over and over again, this is normal, seen this before, everybody buy the dip. I’ve been watching the zombie oil-fracking revolution in this country go into spasms, jerking a few feet forward, a few feet back, gasping for breath, while the cheerleaders agree: perfectly normal, blood pressure okay, reflexes good, lend them more money. This is not normal, it is not okay, it is the Crash of 2015. Continue reading