Podcast: Play in new window | Download

Subscribe: RSS

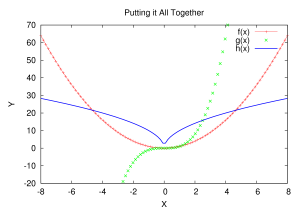

A glance at this simple chart shows how oil prices are determined, and by whom. To the best of our knowledge.

To paraphrase an old saying: For every event there is an explanation that is simple, obvious and wrong. For example, ask why oil prices started to plummet last fall and the simple, obvious answer is: too much supply, mainly because of the American fracking boom, and too little demand because of weak and weakening economies. I have ever been suspicious of people, such as weather forecasters and stock brokers, who have no idea what’s going to happen 24 hours from now but once it happens can immediately explain why it happened, in excruciating detail. Thus on January 7th in this space, I asked a question about this simple and obvious explanation, offered by people who had no clue ahead of time that it was going to happen. The question was this: On what planet does an oversupply of two percent for a machine burning 90 million barrels a day lead to a 50% drop in prices? Continue reading