Podcast: Play in new window | Download

Subscribe: RSS

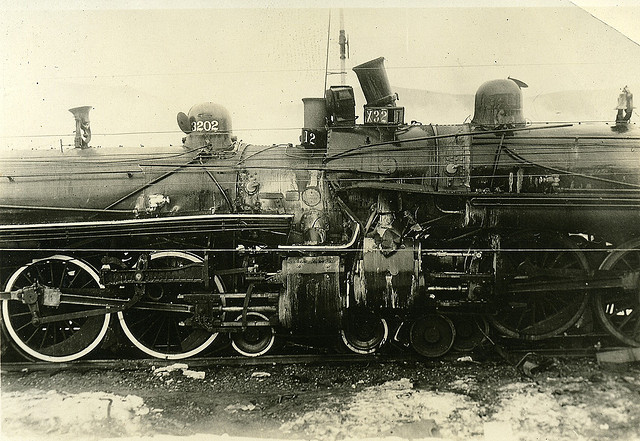

Coming soon to an economy near you: a two-train wreck.

The setup continues of the double train wreck that will decimate the U.S. economy this year; the switches have been thrown to prevent either train from leaving the track, and the engines are accelerating. It doesn’t take much perspective, now, to see both trains, closing fast.

[Note: The Crash of 2015 is not expected to be the collapse of the global industrial economy, which will take a little longer. Just another lurch downward of the shattered Titanic, further unsettling those passengers who do not believe in icebergs.]

The end of the first quarter of 2014 will mark the end of the beginning of this disaster. Train Number One, the fracking oil industry, has only enough fuel on board to go a few more miles — it’s accelerating nevertheless, to impress its passengers — but that’s okay because impact will occur just before the engine quits. Train Number Two, the stock market, which for years has been speeding along the edge of a cliff, burning seemingly endless supplies of cheap money, has nowhere to go but down.

For Train Number One, fracking, the beginning of the beginning was last year’s plunge in crude oil prices. That led to massive and spreading layoffs, a stark decline in the number of rigs fracking for oil, but no reduction in production. The reason: every producer in the fracking patch is up to its eyeballs in debt because each of these 10-million-dollar wells is only good for a couple of years of good production.

So what has March brought us from the patch, as the trains roll on?

- On Monday (March 9), Houston-based oil and gas company BPZ filed for bankruptcy, one day before defaulting on a $60 million payment due to bondholders.

- On Sunday (March 8) Dune Energy of Houston went into bankruptcy after its sale to another company fell through because of — wait for it — lack of financing.

- On Monday (March 2) American Eagle Energy Corporation of Colorado announced that it would not be able to make a $9.8 million interest payment due on a bond issue of $175 million. The interesting thing is, it would have been the very first interest payment on the bonds, which were issued just seven months ago. American Eagle shares have lost 96 per cent of their value; you can snap them up for 20 cents apiece.

- Whiting Petroleum, one of the larger operators in North Dakota’s Bakken play, and occupier of one of the sweetest of the sweet spots in that field, has put itself up for sale as a last resort to avoid bankruptcy. Sure, it had an operating profit of $1.8 billion last year, but to stay on the well-replacement treadmill it had to spend $2.9 billion. Nearly six billion dollars in debt, the company has an apparent net worth (total equity – total debt) of about 65 million.

- The U.S. Energy Information Agency, a longtime cheerleader for the oil “revolution,” predicts that April will see only a tiny increase — the slightest in four years — in U.S. production, because of the 41% decline since December in the number of oil rigs at work. Doesn’t take a crystal ball to see a flatline, or a decline, in May.

How are things going on Train Number Two, the stock market? For a full, hair-igniting analysis read David Stockman’s essay, “Six Years Of Bull Market Bull.” Have the Pepto Bismol handy.

Suffice it to say here in summary that price-earning ratios remain swollen and inflamed, volatility remains violent, and leveraging is still malevolent. Or to put it in non-technical terms: the overwhelming majority of real businesses and real people are suffering and losing ground, while the stock market and the government estimates of “growth” magically levitate into the ether. This is what goeth before a fall.

Thus endeth the beginning. The middle of the end starts April one, when banks review the value of the assets on which they have given credit, and when all kinds of bonds and interest payments will be due.

Hear the rails humming? The trains are coming.

Tom,

I checked the link to the Oilprice.com article on Whiting Petroleum — the difference between their total debt and equity is indeed 66.19, but the chart notes that the numbers are in “$Millions USD” — so their total net worth is $66,190,000. Their situation is a bit better than being zeroed out, but given that shale drilling is a giant exercise in burning cash, it wouldn’t take long for them to go through that… You might want to check this and correct it.

Good catch. Humiliating, but good.

Somebody mention Black Swan event? This one is more like a chartreuse version of the species:

http://theeconomiccollapseblog.com/archives/last-great-run-u-s-dollar-death-euro-74-trillion-currency-derivatives-risk

The Last, Great Run For The U.S. Dollar, The Death Of The Euro And 74 Trillion In Currency Derivatives At Risk

Thanks for another great post Mr. Lewis!

Vince – you haven’t been paying attention, your smokin’ some great shit, or you’re delusional. Which is it?

Easy, Tom, please. Not the level of discourse we like here. Disagreeing is good, disagreeable is not.

Got it, Mr. Lewis. Sorry Vince – you could be just kidding too.

Jim Cramer isn’t terribly worried — he doesn’t see a big wave of bankruptcies coming, “because of the billions of dollars that want in and the lack of need for them”:

http://www.msn.com/en-us/money/markets/cramer-the-gigantic-oil-crash-that-hasnt-occurred/ar-AA9GO9K

Hmm — if billions of dollars still want in, I wonder why those dollars didn’t rescue BPZ, Dune Energy or American Eagle…

Vince might live in the SF Bay Area a similar boom town? As I do. Alternative press is my lifeline to the situation of those who do not inhabit the same privileged bubble. Everyone here is stoked for the new iWatch… it’s easy to assume everything is great.

I saw some “U.S. experiences wealth increases” headline in passing yesterday. We all know that this wealth has all gone to the already-wealthy, and is largely fictive anyway… but between public iWatch celebrations and mainstream media’s constant tune, it takes considerable effort to get a normative view of things here where I’m sitting.

Western half of US going into megadrought, and aquifers already depleted. Eastern half sinking into the ocean, and can’t count carbon. Heck with the paper ponzi scheme, how many ways can you spell dhoum?