Podcast: Play in new window | Download

Subscribe: RSS

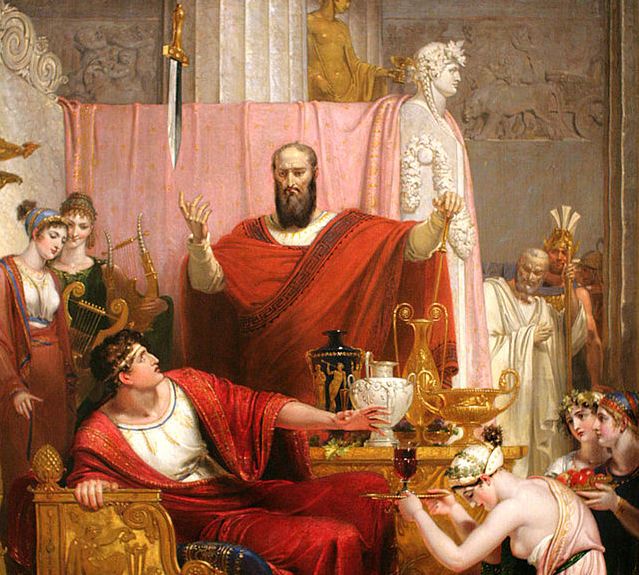

Damocles learned that when you know about the sword up there, it’s hard to enjoy a life of luxury. Bingo.

In the fable that bears his name, Damocles was unnerved in the midst of luxury and power by the threat of a single sword (representing the ever present possibility of failure) hanging precariously over his head. We, who because of cheap oil enjoy luxury and power in our ordinary lives beyond the imagination of the kings of old, live beneath a veritable forest of deadly blades, all of which are just about to fall. Unlike Damocles, we refuse to look up, let alone move out of the zone of impact. When they tell our fable, nobody’s going to believe it.

1. The Price Sword. The world is paying just over $100 a barrel for the 90 million barrels of oil it needs to get through a day. If the price goes any lower, it will be less than the cost of production from fracking, tar sands and deep ocean wells, which is where all the new oil is coming from. If we have to depend on the old legacy fields of Russia, Saudi Arabia, Mexico and the like, which are all in decline, the price will quickly go up, and when it gets much above $100, experience shows it will drive industrial economies into recession. So that’s two swords — one sticks you if you stand up, the other if you sit down.

2. The Demand Sword. The recession of +/- 2009 drastically reduced our consumption of oil, hence dropped oil prices and then kept them from rising as fast as they would have. As we recover, demand increases, prices go up, pushing us back into recession. As the masses of China, India and Asia have the audacity to try to live like us, with cars and air conditioners, they increase demand for oil, which increases prices, which makes it highly unlikely they will ever get to live like us, which, of course, we will soon not be doing either. So this is really two swords, too — one sticks you if you step forward, the other takes a slice if you step back.

3. The Capital Sword. The oil bidness has done a very good job of not letting us see them sweat. But they are sweating. Not because they have to spend a lot of money to find and develop new sources of oil years ahead of getting them on line — that has always been the case. They are sweating because despite spending more and more on exploration and development, they are finding less and less oil. As Ambrose Evans-Pritchard observed in the London Telegraph recently:

Data from Bank of America show that oil and gas investment in the US has soared to $200bn a year. It has reached 20pc of total US private fixed investment, the same share as home building. This has never happened before in US history, even during the Second World War when oil production was a strategic imperative.

This is of course otherwise known as a bubble, a stampede of money started by the irrational exuberance of the hydraulic frackers. It continues, amid talk of “energy independence” and “America Numbah One,” but not for long. Look around. All the shale operators are under water. Not a single major oil company is involved in the American Fracking Revolution: Shell was, but bailed at the end of last year after taking a $2 billion dollar loss.

The same situation obtains worldwide, for deepwater, Arctic, and traditional sources. Global capital investment by oil companies doubled in just eight years (2000-2008), is running near a trillion dollars a year, and is finding virtually nothing. The major oil companies have already, quietly, begun cutting back on their capital expenditures for exploration and development, which may be the scariest single fact about the oil situation today.

4. The Depletion Sword. The Achilles heel (Too many classical allusions? Okay, I’ll stop.) of the fracking business is the hideous decline rates of the wells. Traditional oil wells lasted for 20 years. These super-expensive, water-guzzling, radioactive and toxic waste-generating babies last for five. That means if you’re an operator and you want to show your investors steadily rising production, you had better bring a new well on line nearly every year. The good times roll on, as long as everybody believes the good times will last forever. But it’s always amazing how fast a party that everybody wanted in on can disperse when it runs out of booze.

5. The Stock Market Sword. With the country’s economy manifestly unrecovered from the Great Recession (or the Minor Depression, whichever you prefer), it makes no sense that the stock market is dancing in the stars, wearing silly hats and blowing on noisemakers while millions sink into poverty. That which makes no sense, collapses. Reality, it turns out, is not just a good idea, its a prerequisite for persistence. (See the Enron Bubble, the Savings and Loan Bubble, the Dot-Com Bubble, the Housing Bubble, and on and on….) So it is not only conceivable, but likely, that within the next few months a standard, garden-variety stock-market correction (the other word for it — “crash”) could suck all the money out of all the fracking plays, at once. Or, the dawning realization that we have been led up a blind alley by the American Fracking Revolution could trigger the market panic that finishes fracking. Either way, it’s a lose-lose scenario.

And to think Damocles freaked out at the sight of one sword.

Nice summary, allegories and all.

I see no hope. Just hopium served up with a main dish of delusion and despair for desert.

Brilliant post, I love the classical allusions. They had it all figured out way back then, everything since has been a rehash. Ever read Thorne Smith’s Night Life of the Gods? Hilarious.

Great essay. i’m posting it over on NBL with a link to here.

I would have added the Population and Pollution Swords too (especially Fukushima – which is a sword all by itself).

Added to business as usual is all the methane leaking out of our aged gas lines and wells, just adding to the scary amount that’s coming from the warming tundra and Arctic sea areas. We’re in deep doo-doo and simply whistling past the looming graveyard each day.

(Too many classical allusions? Okay, I’ll stop.)….don’t stop now, brother – you’re on a ROLL – good article…TY

Phil, your sentiment is exactly what I thought, too, when reading that and I heartily reinforce your encouragement to Mr. Lewis.

Mr. Lewis, the allusions you’ve provided exemplify that the more things change…, except “things” haven’t stayed the same, they’ve gotten much worse! This all seems to illustrate that not only is our species NOT “wise,” we’re not even “smart” enough to learn from earlier and oft repeated mistakes. This article may very well be the best I’ve read on your site! Thank you.

The allusions are fine, and I cannot imagine being anything but mildly humored and entertained by them, given the subject matter. It sure appears that we have a serious looming and growing problem.

One of the largest obstacles is this: how do we get people to see the facts and step forward and act responsibly, when so many are so conditioned to just ignore problems? How do we ensure that the bad news does not overwhelm even the strongest? IMHO, we have to be creative in the presentation, as with these allusions. We have to be brave, to speak up against the loud status quo cheerleaders. And, we have to find real leaders who will carry us into change and recovery.

Marginal cost in the Bakken over one year for new wells: $10B+

Marginal revenue in the same time period: $700M

Math isn’t hard.

I’m actually perfectly okay with the heirs of the ancient Greek legacy so long as they could keep to themselves that way of life which they came up with a couple centuries ago, and which they thought was going to open the gates to a Heaven on Earth but, as it turned out, was instead going to get (most of) them impaled on lots of sharp, nasty points. (If you think something’s going to be ‘cool’, fine, go for it, just don’t force it on others.) Instead of keeping it to themselves, though, they threw their weight around the globe and compelled everyone else — often at swordpoint, so to speak — to adopt that way of life as well, with the consequence that *I* now face the entirely likely prospect of being skewered by lots of nasty, sharp points in the near future as well.

Many actually saw the swords, saw that that way of life wasn’t going to open the gates to a Heaven on Earth. Malthus saw the swords. Donella Meadows did too. So did Jimmy Carter. And so did Paul and Anne Ehrlich. But they were all ignored and ridiculed — just like Cassandra (to draw upon another classical allusion).

None so blind as those who will not see — or whose eyes have been pasted over with sh*t. (The blind seer Tiresias, to draw upon yet another classical allusion, who ironically saw far more than any normal man, would surely have agreed as much.)

Pingback: California Drying and Peaked Oil: Daily Impact Double Feature | Doomstead Diner