Podcast: Play in new window | Download

Subscribe: RSS

The news from Planet Oil continues to be relentlessly upbeat. The United States has surpassed Saudi Arabia in oil production (except it hasn’t, unless you use a very specialized definition of petroleum liquids), now produces more oil than it imports (which means that it still has to import nearly half; during the oil shocks of the 1970s and 80s, we were only importing about a third) and is, in the words of USA Today, “tiptoeing toward energy independence” (which is a very long way to go on tiptoes).

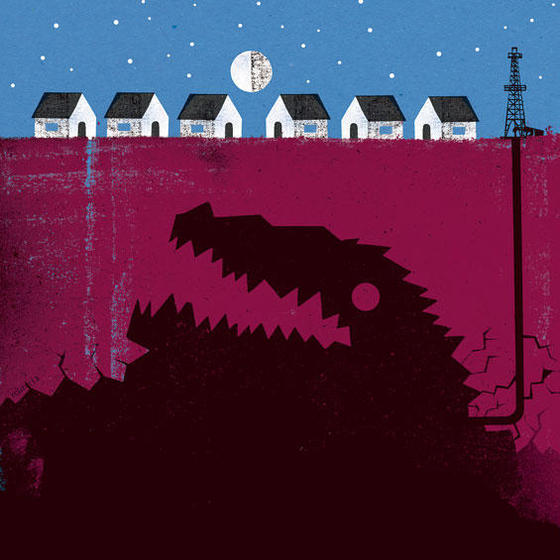

The news from Planet Earth, on the other hand, continues to describe an unfolding catastrophe whose end state is not “Number One,” nor “energy independence.” The most recent cases in point, as reported in a piece by Wenonah Hauter in EcoWatch among others:

-

In just the last few months, a Duke University study linked fracking to elevated levels of methane, ethane and propane in groundwater;

-

a study out of University of Texas, Arlington found high levels of arsenic and other heavy metals in samples from water wells near active natural gas wells;

-

and last month, a study in Environmental Science and Technology found concentrations of radium in the Allegheny River 200 times normal levels, as a result of fracking waste disposal;

-

according to a new study in Science, deep-well injection of slippery fracking waste makes geological faults react to distant earthquakes, releasing earthquake swarms in Oklahoma, Texas and Ohio.

-

Banks and insurance companies are beginning to deny loans and coverage to properties near fracking wells.

But wait, there’s more. It’s not just the downside of fracking that is more and more problematic, the upside is all screwed up as well.

The Monterey Shale in California, according to fracking flacks, contains “reserves” of 300 — wait, no, that’s wrong, 400 — billion barrels of oil. That’s half of Saudi Arabia’s conventional oil reserves and two-thirds of all US shale reserves. A university study financed by the fracking flacks foresaw three million jobs and $25 billion in tax revenues flowing from the recovery of all that oil.

Reality has intruded. Vonoco, Inc., the fracker responsible for the 300-billion-barrel estimate, drilled over two dozen wells, spent over $76 million last year alone, became the second-biggest player in the Monterey, earned no money, and has folded its hand. Chevron (second largest oil producer in the US) drilled some wells, found nothing worth the trouble, and folded its hand.

“The Monterey Shale,” understated an analyst at Oppenheimer & Co., “has not lived up to the hype.” Indeed. Yet among the people who still seem to believe the hype are President Obama and California Governor Jerry Brown. And virtually all of us.

This striking lack of success in the largest repository of presumed US shale oil reserves is not limited to the Monterey. Shell Oil Company in August took a write down of $2.1 billion on its fracking investments, which retiring CEO Peter Voser called the biggest mistake of his career.

Last month, a study of the Barnett Shale near Fort Worth Texas — once thought to be the largest single repository of tight natural gas in the country — found that while hype about the play has not diminished, production has declined by 20 per cent in two years. Of the 16,000 wells drilled in the play since it got hot ten years ago, 12,000 are now classified as “depleting,” a technical term meaning pretty well pooped out. 64 rigs were working the play in 2011, only 35 this year. Carrizo Gas & Oil, a major developer of the Barnett, sold off its assets there in September.

So the smart money on Wall Street, undeterred by what one fracking flack called “a few dry wells,” is pouring into the drilling companies’ coffers because, as Filipino environmental leader Von Hernandez put it, “every investment in fossil fuels is an investment in death and destruction.” And you know we’re not going to run short of those anytime soon.

Call now. Operators are standing by.

(Graphic by the Dallas Observer)